Build Wealth With Precious Metals & Bitcoin.

Precious metal isn't just a material for jewelry design.

It's also a form of currency that can help you build wealth, protect your money from dollar deflation, hedge against inflation, and build savings.

Gold and silver and even platinum and palladium are also industrial metals and commodities that will always hold value.

This means they are long term stores of wealth.

Jewelry designers happen to have the ability to build wealth inside their businesses like no other business on the planet.

Gold and silver are also money and have been for thousands of years. And there is a huge difference between sound money and fiat currency.

As our global monetary system shifts drastically in real time, knowledge of this difference has never been more important than it is now.

It is crucial to hold some assets in different forms of money, particularly SOUND MONEY, which means it will always hold value.

If all of our assets are in paper, or fiat currency, we are putting ourselves at a great disadvantage.

I’ll explain, but first— it’s not our fault that many of us lack knowledge of financial literacy. We simply are not taught how our monetary system works in school. We are meant to ‘trust’ that the system works on our behalf, when in reality it works quite the opposite.

Lack of financial literacy takes away our power to build wealth and have a secure financial future.

It takes away our sovereignty.

When I first became a designer, I had no idea that silver was a currency, a commodity, a form of savings, and a way to build wealth. But after seeing a commercial on TV that asked, "Do you know what the world's reserve currency means?”, I became obsessed with learning about money, monetary policy, global economics, investing, and building wealth.

My superpower is consuming knowledge.

Consuming knowledge is power.

What I learned is this:

The world’s reserve currency

The United States runs the global economy by holding the status of the world’s reserve currency and also what is known as the petrodollar. Countries conduct international trade in dollars. Oil has been sold in dollars by agreement with SA for decades, but this is rapidly changing.

Fractional reserve banking

Our dollars are not actually in the bank (true in ALL countries) due to fractional reserve lending. It is leant out in the form of loans. 10% of our deposits used to be kept in the bank but this is now 0%. The recent bank runs demonstrated what can happen when people get scared and want their money. Many people lost it which is why the Fed came out insuring all deposits. However, this is impossible. Even the FDIC only has a fraction needed to insure the total of all deposits and the government can only print the money to cover the rest, which increases inflation and debases our currency.

Every single fiat currency in the history of the world has gone to zero

Fiat is paper money backed by nothing (true in ALL countries except Russia). It is printed out of thin air and added to the money supply. This causes inflation and steals the wealth and time of us all. The more currency in circulation, the higher inflation as there is more currency competing for the same goods and services.

The dollar is backed by nothing of value

The dollar used to be backed by gold until 1971 when it was taken off the gold standard. Since this time, dollars are backed by absolutely nothing except ‘trust’ in the US government to pay its debts. They just keep printing and spending. It is ‘paid back’ with our taxes. (again true in all countries, except Russia)

Inflation in created and controlled by the system.

Printing money expands the money supply which increases inflation because there are more dollars in circulation competing for the same goods and services. Every time the government gives millions (or billions) to other countries, spends money and increases our 33 trillion debt, it actually increases inflation. If countries who hold their reserves in dollars decide to dump those dollars and they come flooding back into our money supply, guess what happens…more inflation. So, inflation is caused by money printing and government spending. Ultimately, it is theft.

Countries around the world and central banks are hoarding gold by the tonnes in higher levels than anytime in history.

Why? Because they know that trust in the US dollar as the world’s reserve currency is fading and that an economic shift is taking place. China, who holds a large amount of our debt in the form of US treasuries, is currently selling them at a rapid pace. If banks and countries are hedging with gold, don’t you think we should have some too?

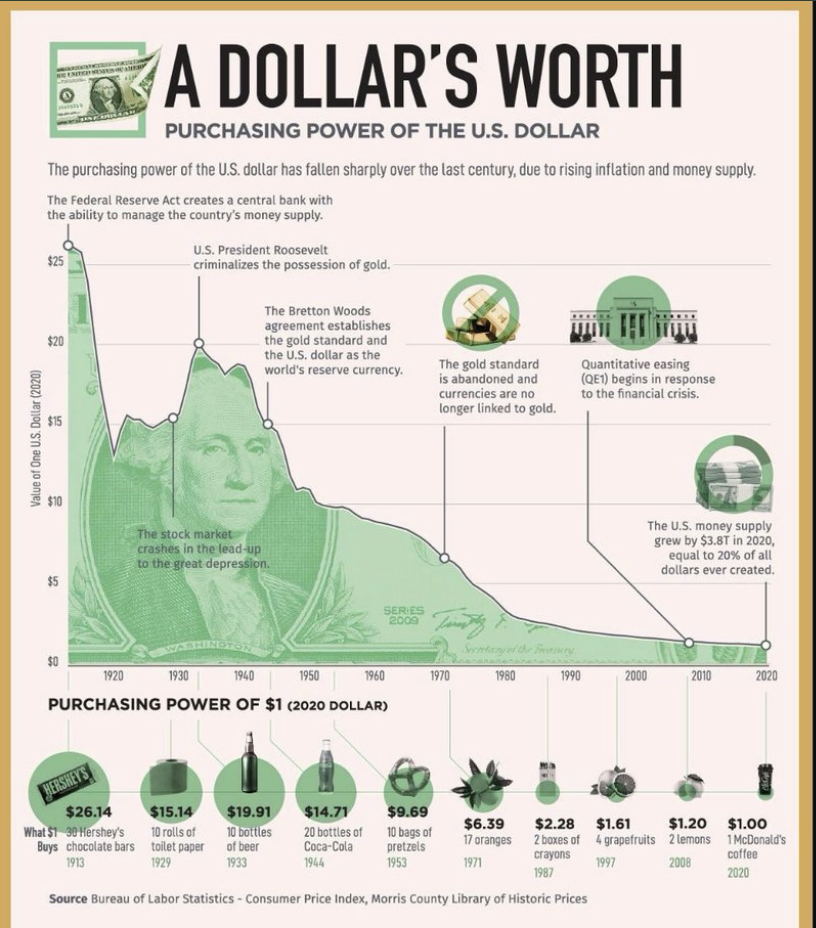

The US dollar has lost 95% of its purchasing power since the creation of The Federal Reserve.

Our money buys less and less because printing money debases our currency. (see image below)

Countries are actively and in real time circumventing the US dollar.

They are forming alliances such as BRICS against the US which more and more countries are joining. Saudi Arabia is in talks with China to price oil in the yuan instead of the dollar. If they no longer ‘trust’ the dollar and ‘trust’ is what the dollar is hanging onto by a thread…shouldn’t we make a plan to protect ourselves?

The Federal Reserve isn’t a federal organization

It’s a private corporation with stockholders. They cause the very problems that not just everyday Americans experience, but world citizens. Just look at the collapsing currency of Japan right now. They create the widening gap between the rich and poor, not capitalism. Free markets don’t manipulate. People do. Every country has a central bank.

Money has characteristics that make it money

money is durable, divisible, fungible, portable, verifiable, scarce, and accepted as money. Gold isn’t portable and that’s why it was used to back paper currencies. I think we can all agree that the dollar is not scarce.

Consider investing in assets like gold and silver, and take advantage of their potential for long-term growth.

By building up a collection of these metals, we can ensure that we have a stable source of wealth that will hold its value over time (for now, I explain below).

By taking the initiative to learn about financial literacy on our own, we can gain the knowledge we need to make informed decisions about our finances and build wealth.

As I showed you last week—To achieve PROSPERITY:

Before I give you resources to help, I want to introduce another currency, commodity, form of money, asset, property, wealth protector, protocol, uncorruptable and decentralized technology, hedge and inflation decreasing revolution—Bitcoin.

Firstly, Bitcoin in not crypto. There is crypto and there is Bitcoin. They are not the same.

Secondly, Bitcoin is growing faster than all banks and financial institutions in history. It has been pegged the best performing asset in this decade by Goldman Sachs. It has increased in value almost 100% this year alone!

Why do governments, central banks and mainstream media detest it? Because its your FREEDOM from their corrupt system of theft. They make us think it is nothing, that is a dead, dirty energy, that it will steal our wealth. Actually it only steals their grasp on our wealth. Why do you think the central banks buy up all the gold?

Yes it is volatile, but when you zoom out, you can see a clearer picture of growth. All disruptive technologies start out volatile—like the internet, the automobile, cell phones. In fact, Bitcoin is currently on the same trajectory to mass adoption:

It is rising in countries, credit card companies, payment platforms. hedge funds, tech corporations like Microsoft and more.

It’s here to stay.

Wall Street companies—holding trillions of dollars—are on the verge of investing billions for their clients in year one alone. Blackrock, Ark, Fidelity, and 9 others are currently waiting for their spot Bitcoin ETF applications to be approved by the SEC. An ETF is an investment fund that tracks the performance of a specific index or underlying holding, often leveraged several times more than a stock.

These approvals are imminent , which means the price of the underlying holding—in this case Bitcoin—is about to explode. It is up over 20% in the last 5 days (currently 10/27/23). It surged on the news that Blackrock and Ark have listed their ticker symbol for their incoming ETF. On just the news of it happening!! The approval hasn’t even happened yet.

Not only this, but the next halving is in 6 months. A halving occurs every 4 years and is part of Bitcoin code, which cannot be changed. During a halving, Bitcoin becomes harder to mine and the reward for mining is decreased. This counteracts inflation because of its scarcity. This means that despite Wall Street adoption and even mass adoption by the world, Bitcoin is coded to increase in price while decreasing inflation.

Incredible right?!

As this continues to occur—mass adoption and institutional investing—the monetary value of all other assets will decrease. This includes real estate, stocks, and even precious metals. They will retain their utility value, but their monetary value will be siphoned into Bitcoin as people, countries, and funds move their money from one to the other.

A transfer of wealth and a global economic shift is occurring in real time and most people don’t even know it’s happening!

It does take open and free critical thinking to understand it. An open mind to what it can do for the world—end wars, end inflation, end theft of wealth, lift millions out of poverty.

How does it end wars? It can’t be printed or lost or laundered. It is coded to cap at 21 million bitcoin, 19 million of which have already been mined. Every single transaction is proofed on a ledger. Therefore, politicians cannot print it and use it to fund wars.

It is a path to PEACE & PROSPERITY.

And why it’s labeled revolutionary.

Look at El Salvador, for example—a country that had the worst crime rates in the world. It wasn’t safe to visit. It was overtaken by the MS-13 gang who terrorized the country until Nayib Bukele became President, made Bitcoin the country’s legal tender, and put 55,000 MS-13 members in prison. Now El Salvador is the safest country in the world to visit and has become incredibly prosperous. They are also using volcanic steam to mine Bitcoin.

MicroStrategy, a billion dollar corporation owned by Michale Saylor, an aerospace engineer, moved all of his reserves into Bitcoin during COVID when he realized his company was doomed and he needed a revolutionary solution to save it. He found Bitcoin, understood its power and invested millions. His company is now valued at 5.75 billion dollars and is up 132 million from its original Bitcoin investment (Source: cointelegram.com).

I suggest learning as much as possible from Michael Saylor. He is continually giving interviews and is one of the smartest people on the planet. Here is one example.

He isn’t the only one. The experts I’ve been following for years ALL recommend Bitcoin as well as gold and silver right now. Some of the greats are Robert Kiyosaki, Porter Stansberry, Doug Casey, Michale Maloney. I have more listed below.

Investing

When you invest in different forms of money, try not to think about it as buying something. Think about it as exchanging your currency. You aren’t losing wealth. You are transferring it to a different form. You are protecting your time, energy, and life force that is your money with sound assets that will always hold value.

If you do invest in Bitcoin, make sure to put in your due diligence. Keep it off of exchanges, which are kind of like banks, and hold it securely in your own private wallet. I use Trezor. (not financial advice)

Due Diligence

Please don’t take my 15 years of consuming financial knowledge as gold!

Do your own due diligence and research all of the above listed terms to get an understanding of how monetary policy works and who it actually works for. Understand what money really is so you can make informed, sovereign decisions for your financial future.

Resources:

(disclaimer: this is not financial advice)

Mike Maloney goldsilver.com (free book on how to invest + free series on the history of money) You can also purchase metal from him. You can also pay for it in Bitcoin!

Eric Wade, blockchain + crypto expert, financial manager, entrepreneur

Mark Moss, author, investor, educator, entrepreneur

Robert Kiyosaki, author, investor, entrepreneur

Nomi Prins, economist, finance expert, author, journalist, and public speaker who writes about Wall Street and the US economy.

Stocks that are backed by physical metal: PSLV, SPPP, PHYS

Books: The Age of Cryptocurrency, The Bitcoin Standard, Softwar, The Cashflow Quandrant

Google and Youtube!

If you are a jewelry designer, learn how many revenue streams are available to you and how you can build wealth in your business with precious metals using this Wealth Building Business Model.

—Be A Consumer Of Knowledge.

xx Meaghan